Our strategic partners work to find profits lost or unrealized for your company

Services

Merchant POS Financing

Your clients, patients and customers will be able to make large purchases and obtain necessary treatments with this Point of Sale financing service.

ERTC Tax Refund and Advance Payment

Was your company adversely affected during the period between a March 2020 to December 2021 due to government mandated closures or inventory slowdowns. You mat be entitled to a significant refund of your payroll thru this program.

Visa/MasterCard Interchange Fee Recovery

A class action lawsuit that is nearing being finalized in the courts will provide $5.5 Billion in relief to merchants that utilized there merchant accounts between January 1, 2004 thru January 25, 2019.

Tax Credits and Savings Programs

About 5% of the IRS code is written to tell you how to pay your taxes. The remaining 95% gives you, the tax payer methods to avoid paying Federal taxes. Programs are out there waiting for you to minimize your taxes.

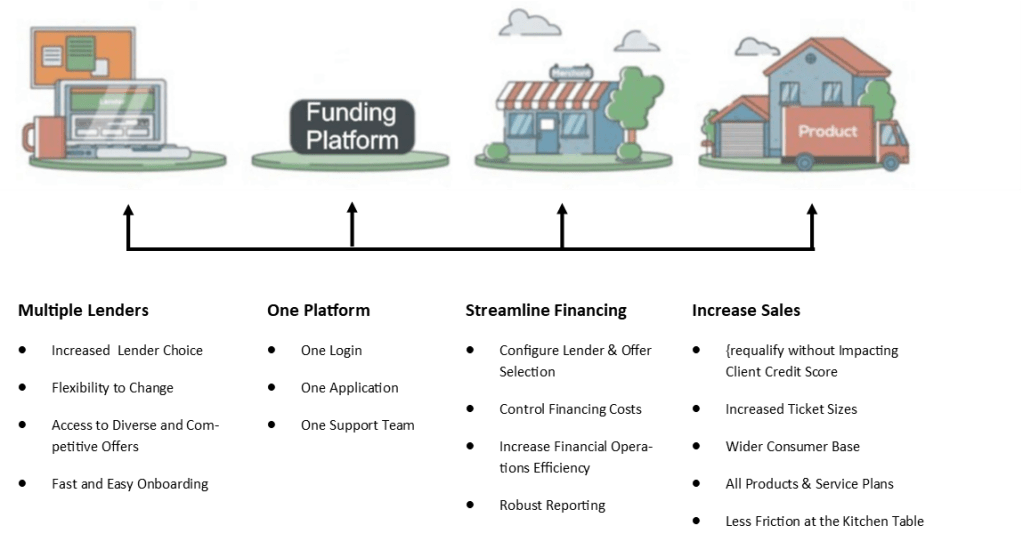

Merchant POS Financing

Our Strategic Partner brings point-of-sale (POS) financing to underserved businesses like brick and-mortar retailers and service providers. Use it to convert more customers at checkout by

helping them buy now and pay later.

- Home Improvement

- Carpet Cleaning

- Construction

- Electrical

- Flooring

- Home Inspection

- Home Remodeling

- Interior Design

- Landscaping

- Painting

- Plumbing

- Pools & Spa

- Roofing

- Security Systems

- Solar

- Health Services

- Medical

- Dental

- Dermatology

- Optometry / Eye Wear

- Ophthal-mology

- Orthopedic

- Chiropractic

- Hearing Aids

- Med Spa

- Medical Equipment

- Pharmacy

- Physical Therapy

- Weight Loss

- Massage Therapy

- Retail

- Art Work / Framing

- Auto Repair

- Cameras / Video Gear

- Electronics

- Furniture

- Jewelry

- Photography

- Retail-General

- Salon-Spa

- Scuba / Surfing Gear

- Veterinarian Services

- Window Washing

Merchants that cater to their customers’ and clients’ financial needs experience higher customer satisfaction rates. Similarly, offering flexible financing options can improve customer acquisition efforts and place you ahead of the competition. Consumers are more likely to seek products and services from merchants that provide them with budget friendly payment options.

Rather than forego purchases, merchant financing can encourage consumers to make large-sum purchases or add-ons. In turn, this increases your business’s revenue, sales, and cash flow.

Merchant Financing Options upon Checkout (all may not apply in every situation)

This service provides your customer multiple options when purchasing your large ticket items.

Choices include: Buy now pay later, Lease to own, Split Payments, Installment Loans, Low APR, Direct-to-Consumer loans, Lines of Credit, Direct-to-Merchant Financing

What Information Does the Consumer Need to Provide to Request POS Financing?

It only takes a few minutes to fill out the financing request form. It requires some personal, employment, and financial information from the applicant.

How Long Does the Average Loan Request Take?

Typically, the loan request process takes a few minutes to complete. Similarly, most applicants receive on-screen results in a few minutes.