Great News For A Short-Term or Vacation Rental Property Business

No matter where you go, if you stay overnight, you need some place to sleep and shower. For dairy inspectors in 1915, the YMCA or the bus station might have been okay, but real hotels have been the mainstay choice for years now and the RV is good for the family that spends lots of time outdoors.

However, the online vacation marketplace has made it easy for travelers to search online for all sorts of alternative places to stay. You can look for condos, cabins, homes, and apartments in locations all over the world. This trend is good news for people who own vacation homes or second houses that they want to rent out. It is great news for people who want to build a short-term or vacation rental property business.

You might think that you have to live in Myrtle Beach or Hawaii to start a vacation rental property business. But this is not true. You can start a business right in your own town, right here in Texas.

Truly, these online vacation home marketplace sites have revolutionized the short-term rental business. They are a great tool for the rental property owner. Not only do they make it easy to advertise your property as far as the web can reach, but they also allow you to receive funds from buyers securely. A few of these vacation rental marketplace sites are listed here so you can check them out for ideas:

Air BnB: https://www.airbnb.com/

Homeaway: https://www.homeaway.com/

VRBO: https://www.vrbo.com/

There are many things to consider with any investment or any time you start a new business. Most of the time, you need a loan. To get a loan on a property, you need to know what property you want and how much you need to borrow. Here are a few tips to help you get started on your short-term rental property business plan.

The Property: “A superb location”

Be inspired and look for a property that you love and consider whether it is convenient to public transportation and/or has easy parking for private cars? Look for a single-family home or for a large house that has been converted into a triplex. One good way to start is to live on one floor, rent out one floor fulltime, and rent one as a short-term vacation rental. Remember that each floor or living space will need to have a separate means of access. You can consider doing the remodeling yourself to make a large home into a triplex. Construction funds should be included in the funds you need for your business loan.

Laws: “You can’t fight City Hall”

Check the zoning laws for the local government to make sure the community does not have rules against owners renting out homes or offering rooms or floors of their house for short-term rent. Do this before you buy. As they say in the neighborhood, “You can’t fight City Hall.” Well, you can, but it will be expensive, and you will probably lose. So, check the laws before you invest.

Furniture: “Very clean and inviting with a comfortable bed”

A long-term rental can be rented without furniture, but short-term rentals need to be furnished so you will get rave reviews on the online websites and earn repeat customers. Put these items into your plan and trim them from there depending on your funds.

You will need to have a washer and dryer available. If you are choosing the triplex, one in the basement might do, but stackable ones on each floor would be a real amenity and earn you the coveted, “They thought of everything to meet our needs.”

You will need a refrigerator, dishwasher, microwave, oven, and the latest HVAC system.

For the bedroom you will need a bed or beds, bedroom furniture, sheets, blankets, pillows, comforter, end tables, lamps, dressers, flat screen TV, hangars.

For the living room you will need another flat screen TV, at least one couch, easy chairs, reading lamps, book cases, and maybe a rug.

For the kitchen, table, chairs, silverware and dinnerware, coffeemaker, and cookware.

You can great prices at antique shops and thrift stores for furniture and decorating items like mirrors, pictures, book shelves. Some of the items you need, you will probably need to buy new, like the linens and the HVAC systems.

The Welcome Package: “They were great hosts”

Put together a welcome package. This package will tell renters about what amenities are offered in the space and in the town. Include useful information about public transportation and sites of interest.

Advertise: “It was so easy to find them.”

Advertise on as many vacation home marketplace sites as possible to get your name out there, get the reservations flowing, and start receiving funds securely. It is also a good idea to build and maintain a website.

Be Available: “They were the friendliest people”

It is very important that you available for emergencies and questions and if possible to check guests in. Take calls from interested parties and be friendly.

Build from One to Many

Grow. If you love the business and are making some money, be obsessive about it. When you can afford it, buy another property and enlarge your business.

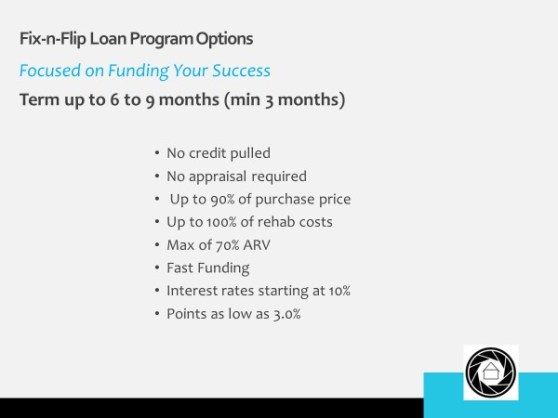

Now that you are ready with a property and a plan, I can help you with a loan program to purchase your rental property. I am happy to announce that a loan program is now available to purchase rental property for the purpose of building your short-term or vacation rental property business. We have funds available for single-family residential property, condos (warrantable only), and ocean beach front property.

I would be pleased to have you call or e-mail too.

Pat St. Cin

Patrick@InvestorsLendingSource.com

512-213-2271

Austin, Texas