There are several reasons why a fix-n-flip investor might want to secure a fast loan to cover a gap. A gap loan, as the name implies, is a loan that bridges a span of time. It helps you gain control of a property quickly even if you are still scrambling to get all your paperwork done for a full rehabilitation loan.

A Buyer in a Hurry

At some time or other, you might face a seller in a hurry. One situation that puts a seller in a hurry is foreclosure. Many property owners in this situation are in denial so they wait until the last week or so, or even days, before the foreclosure sale to act on saving their credit. To save their credit, they must pay the bank all they owe on the mortgage right now. The house might actually be worth much more than what they owe if they have been paying on the loan a long time or put a large payment down on it. But, a foreclosure on their record will ruin their credit. So, for them, it is better to sell at a discount and survive to buy another house another day.

In this scenario, an owner in foreclosure has agreed to sell the property to you at a steep discount, but they need to close the deal quickly. You, the investor, want to buy this property and you make an offer. However, the competition is extremely stiff, and another investor is sitting in the wings waiting to obtain the property. Your offer locks up control of the property temporarily. You need to move quickly to secure a loan. Normally the loan process takes a minimum of 7 working days and typically takes 10-15 working days.

A Nonrefundable Deposit

Another reason you might need funding in a hurry is that you have stumbled upon a wholesale purchase with a tight deadline to close, perhaps 2 to 5 days. The property is ideal for your purposes and you want to make an offer. However, if you don’t get the deal closed by the deadline, you will lose the nonrefundable deposit you are required to put down and control of the property you are seeking.

Getting Control of the Property

Here is where obtaining a gap loan is useful. A gap loan allows you to purchase the property as is while you are in the process of obtaining a rehab loan. The gap loan can be secured in 2 to 3 days typically. Your strategy is to obtain control of the property through this gap loan, begin paperwork to refinance the loan immediately and eventually complete the rehab and offer the property for sale.

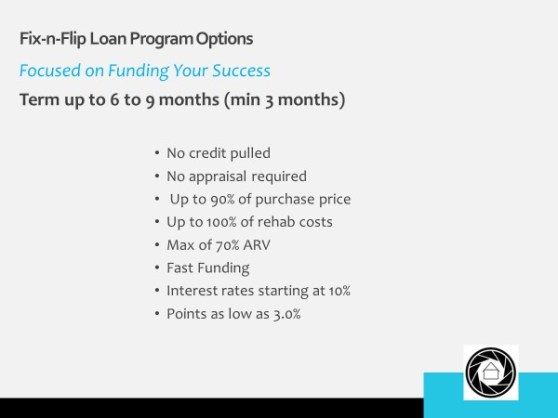

REI Capital Resources has funds available for fix-n-flip loans with terms up to 6 to 9 months with a minimum of 3 months.

E-mail or call for more information on minimum and maximum loan amounts, interest rates, terms, and fees for specific project. I can help you with first liens only and these loans are limited to the Austin, DFW, Houston, and San Antonio Metro areas.

Pat St.Cin

Patrick@reicapital.cash

512-213-2271

Austin, Texas

Next, get a remodeling contractor to give you a bid on the repairs and a plan or time frame the repairs will take. You might want to get several bids and choose the one that looks best to you.

Next, get a remodeling contractor to give you a bid on the repairs and a plan or time frame the repairs will take. You might want to get several bids and choose the one that looks best to you.