I have had to really watch myself with this social distancing thing. I am a toucher. I lean into hugs, always shake hands, pat shoulders. I soak up touch. When I’m talking, I find myself creeping closer to the person I am talking to as if I can’t see them or hear them well enough at a distance.

I am certain this economy will recover. People still need homes and loans, but we still may not be able to shake hands for a long time.

In some American states, selling real estate is still an essential occupation as is banking. When we are selling homes or signing loan papers, we are working with others in small groups, but we may be working with people from other states or countries and need to keep ourselves and our families safe during this Covid-19 pandemic.

FIRST & IN THE FUTURE

Use only appointment-only open house formats this way you know who is coming when and you are not surprised. But advertise this new situation on the door so people don’t come in unannounced. This will help you assure that only one group is walking through a house at a time.

Use social media to make virtual tours, even if people will want to see a property before they buy. They can spend more time exploring the house online and visit the website multiple times without having to worry about personal protection equipment.

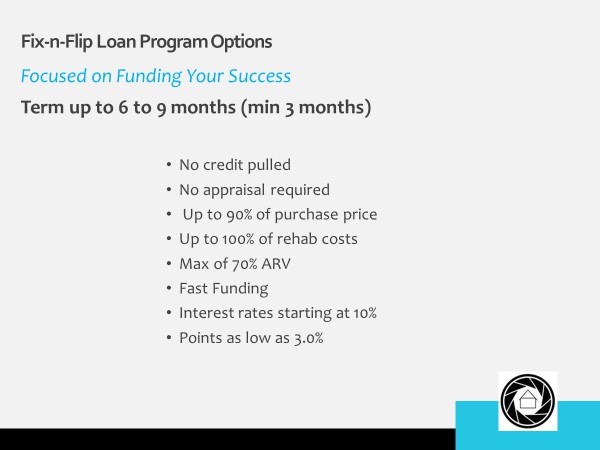

Fill out the BLN application at http://reicapital.blnsoftware.com/ or send my an e-mail or give me a call.

YOUR DAILY PREP

Prepare business cards and signs to reflect appointment-only restriction.

Place a separate set of clothes and shoes for home just inside the door to your home or in your mudroom if you have one.

Remove your wedding ring.

Stop using a purse or briefcase and instead use a plastic or washable cloth bag for business cards, open- house guest books and pens.

Place a fresh set of business cards and other items in 6 or 7 bags and label them for each day. Take a fresh bag of supplies with you to an open house or to the office every day.

Equip yourself with gloves, face mask, face shield, and booties for your shoes (For open house).

AT THE OPEN HOUSE

Spend time cleaning doorknobs and surfaces before and after a showing, A glossy kitchen counter can be a magnet for a tactile person. They just have to run their hands over the surface. Windowsills might also need some disinfectant. If your store is out of prepared disinfectant use original unflavored Listerine in a spray bottle.

Wash your hands before and after a showing.

Invite your potential buyer to wash their hands before and after touring the house. And, provide a hand sanitizer.

Remind everyone to be aware of where they set down their mobile phone so they don’t set it down on counters or in the bathroom or on other shared surfaces.

Stay alert to what is touched during a showing so you can be sure to clean these surfaces with extra attention after the showing.

You can wear gloves but know how to take them off and dispose of them correctly without contaminating your hands and everything around you when you take them off. Peel them off before you touch your car, turn them inside out and place them in a plastic bag and tie it shut. Put the plastic bag in the trunk of your car for later disposal if there is no trashcan nearby.

Keep your distance from each other. This is the best way to prevent the spread of a respiratory disease.

Wearing a mask will protect you and your client. While wearing a mask, smile more, wink and speak so you are sure to acknowledge people even if you keep your distance and do not touch.

COMING HOME

Hang up the bag of supplies you return with near the door, spray it with disinfectant and Let the bags hang unused for a week to 9 days so the virus will have time to die out before you use the bag again.

Strip out of your outside or work clothes and shoes near the doorway or in the mudroom.

Wash your hands.

If you are wearing gloves, dispose of them before touching your clean clothes. If you want to reuse them, place them in a plastic bag so you can disinfect them later.

Dress in your indoor clothes.

With gloves on, bag us your work clothes and wash them immediately.

Let jackets and hard items rest for a week or 9 days at room temperature before using them again to give the virus time to die out.

An open house is not as dangerous as a concert or a basketball game. Usually there are 3 people involved and they are usually adults. Perhaps sometimes parents bring their children, but that is something that can be avoided right now.

Unlike a family, the 3 people involved in the showing usually do not know each other intimately. The buyer does not know where the realtor had been recently and neither know where the homeowner has been recently if they are still living in the home being shown. Precautions need to be taken so you don’t catch the coronavirus or bring it home to your family.

I hope that I can be of help to you this month. I can be reached at

512-213-2271

Austin, Texas